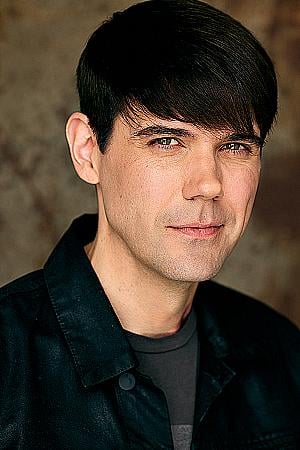

Corporate Explainer - Informative, Professional, Genuine, Natural

Description

Vocal Characteristics

Language

EnglishVoice Age

Young Adult (18-35)Accents

North American (General) North American (US General American - GenAM) North American (US Midwest- Chicago, Great Lakes)Transcript

Note: Transcripts are generated using speech recognition software and may contain errors.

question, What are my options for growing my retirement assets, aliens answers when it comes to building your assets, to help pay for your retirement? The basic investing concept you first need to understand is the relationship between risk and return. Generally speaking, the greater the potential for return, the higher the risk that this asset could lose value. On the other hand, when the risk is lower for an asset, then your potential return tends to be lower to the key to investing is to know how much risk you can tolerate for the potential returns you're hoping for. One well established strategy for this is a balanced portfolio containing a mix of asset classes, usually including growth assets like stocks or equities and other assets like bonds and bond funds. To help provide stability. By increasing or decreasing the proportions of each, you're able to customize a balance between risk and return, that may be appropriate for your long term financial goals and your own tolerance for risk. That's been an effective strategy for the past three decades. But now the financial landscape has changed dramatically and heightened the risks for both equities and bonds, bonds are being challenged by low yields as well as the possibility of rising interest rates, which can stress bond returns even more. That may put more pressure on the rest of your portfolio to make up the difference with greater returns on the equities portion, even though equities are inherently more volatile, with the possibility of another significant market downturn always present. And if that happens, you may not have time to rebuild the value of your portfolio before you retire. So how are you going to grow your assets? Do you accept greater risk in order to get potentially greater returns? Or do you seek lower risk even if that makes it more difficult to build up your assets and could delay your retirement option one or option two? Not an easy choice, is it? So how about a third option one that can help you seek long term financial returns and potentially reduce the risk in market volatility in this option, along with equities and bonds, you may choose to use a portion of your portfolio to purchase an asset called an index variable annuity or I. V. A. An index variable annuity is an insurance product that provides the opportunity to build a portion of your retirement assets. Tax deferred with a variety of annuity payout options and a built in death benefit during the accumulation phase. An index variable annuity also gives you the choice of allocations that may offer different levels of protection and performance potential through various index or variable options. So you can create a different balance of risk and return potential that may be appropriate to you. Please note that variable annuities are subject to investment risk, including possible loss of principal investment returns and principal value will fluctuate with market conditions so that units upon distribution may be worth more or less than the original cost. So if you need to grow your retirement assets and are concerned about having a portfolio with too much risk or too little potential return, including an index variable annuity can help you create a different balance between risk and return potential that can help meet your goals. Talk to your financial professional about how an index variable annuity may be appropriate for your retirement strategy. You can also learn more about index variable annuities and their features at aliens life dot com.

Tags

Announcer, Instructor, Presenter, Demonstrator, Real Person, Believable, Conversational, Corporate, Easygoing, Educational, Friendly, Informative, Natural, Professional, Straightforward, North American (General), North American (US General American - GenAM), North American (US Midwest- Chicago, Great Lakes)

Top Talent

Top Talent